Winners Circle RV Resort

Strong Cash Flow, and Scalable Growth

An established, high-demand RV community with strong cash flow and substantial growth potential. With a prime location, low-risk expansion of 85 new RV pads, and strategic rent increases, Winners Circle is positioned for sustained, long-term returns.

RV Park Investment Opportunity

Immediate Cash Flow Yield & Rental Upside

50%+ Return of Capital: Refinance Month 30

Approved Expansion Plan: Lower-Risk Development than Multifamily

Capital Appreciation Realization Year 4

Why THIS RV Park?

Below Market Acquisition

10%+ discount on price per pad.

Stabilized Cash Flow

90% Occupancy with minimal seasonality from long term tenants.

Market Rent Upside

Current monthly pad rents 20%+ below comparables.

Fast-Tracked Lower-Risk Development

Existing approval for 85 new pads, cutting out 18-24 months of the building approval process.

Short Construction Timeline

9 Months from first shovel to first rental.

Strong Demand

Mobile’s industries are growing, which means a growing workforce.

Property Overview

Winners Circle Property Overview

Theodore, AL

Location

88

Existing Pads

3

Existing Permanent Rentals

85 Full Hookup

Approved Pads to be developed

88%

Current 12-month average occupancy rate

Located close to Employers & Seasonal Employment Areas

Excellent Reviews

A Simple Business Plan with Extraordinary Results

- Optimize existing 91 sites to increase rents to market potential.

- Add 85 premium sites & 1 bathhouse

- Income Diversification: Transition Winners Circle from a low-end “trailer park” model to a mid-level mixed RV park with both transient guests and long-term residents.

- Stabilize & refinance – return 50% of invested capital (invest $100 and get $50 back early)

Winners Circle Potential Investor One-on-One

Unlock exclusive investment opportunities with a private one-on-one session. Join the Winners Circle today!

Pad Count Increase

| Existing Pad Count: | 91 |

| New Pad Addition: | 85 new RV pads |

| Vertical Construction: | 1 Bathhouse |

| Total Pads After Expansion: | 176 |

Pad Count Increase Includes

| Upgrade RC Pads: | Mix of Larger Gravel and Concrete Pads with enhanced finishes and more privacy |

| Premium Utility Infrastructure: | 30-amp and 50-amp electric service, EV charging stations, water and sewer upgrades |

| Luxury Amenities: | Pickleball courts, fire pits, upgraded dog parks, solar power, clubhouse, storage |

| Enhanced Landscaping: | Professional landscaping with irrigation and drainage systems |

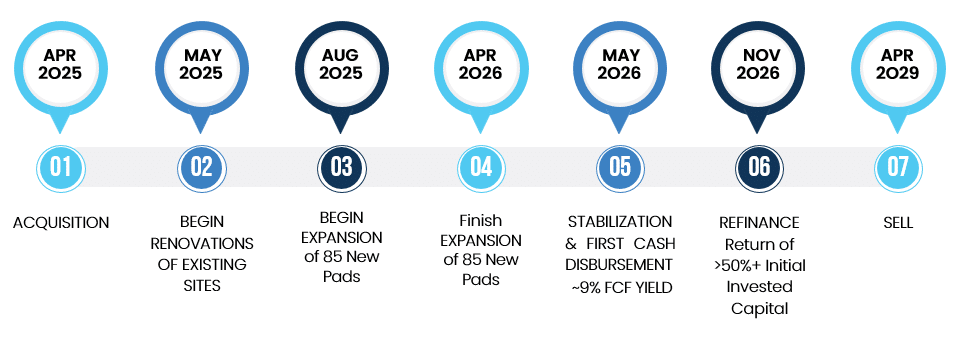

Short 4-Year Investment Timeframe

Purchase 2024 & Exit Year 4 (2028)

Property at Acquisition

Purchase Price: $4,250,000

Purchase Cap Rate: 7.1%

Existing NOI: $312,000

Property at Sale (Projections)

Sale Price: $14,350,000

Exit Cap: 7%

NOI: $1,004,033

Opportunistic Purchase with Reduced Risk

We are purchasing the asset after it’s already gone through extensive restructuring and stabilization with approved development plans in place.

The riskiest part of development is getting construction approval. Winners Circle is being purchased with development approvals in place, saving us 18-24 months and extensive costs.

Investor Returns & Financials Projections

NOI

$1,004,033

Exit Value (@ 7% CAP RATE)

$14,343,332

Propert Value Increase

$10,093,332

LP Gross IRR (Project Level)

34.9%

LP Gross Equity Multiple

2.9%

Gross Returns Per $100k Invested

$290,000

LP Net IRR

27%

LP Net Equity Multiple

2.3x

Net Returns Per $100k Invested

$230,000

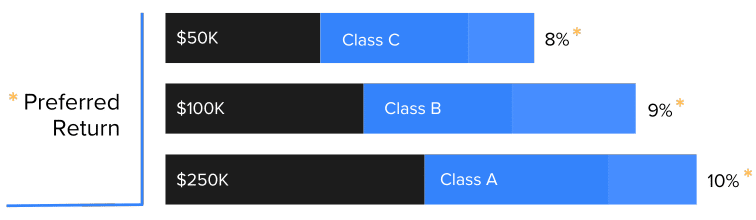

Preffered are returns based on minimum capital invested

* A preferred return (pref) is the percentage amount investors receive before general partners earn a share of the profits. Read more on preferred returns here. Preferred returns are based on investment contribution.

Winners Circle Potential Investor One-on-One

Unlock exclusive investment opportunities with a private one-on-one session. Join the Winners Circle today!

RV Parks: Low Income Volatility & High Profit Margins Compared to Hospitality

Existing Long-Term Residents on 88 Sites & 3 Permanent Rentals

- Diversified Income Streams

- Year-Round Occupancy

- Approved Development Permits for 85 New Pads

- Booming Workforce Housing Demand

- Existing Rents are Below Market

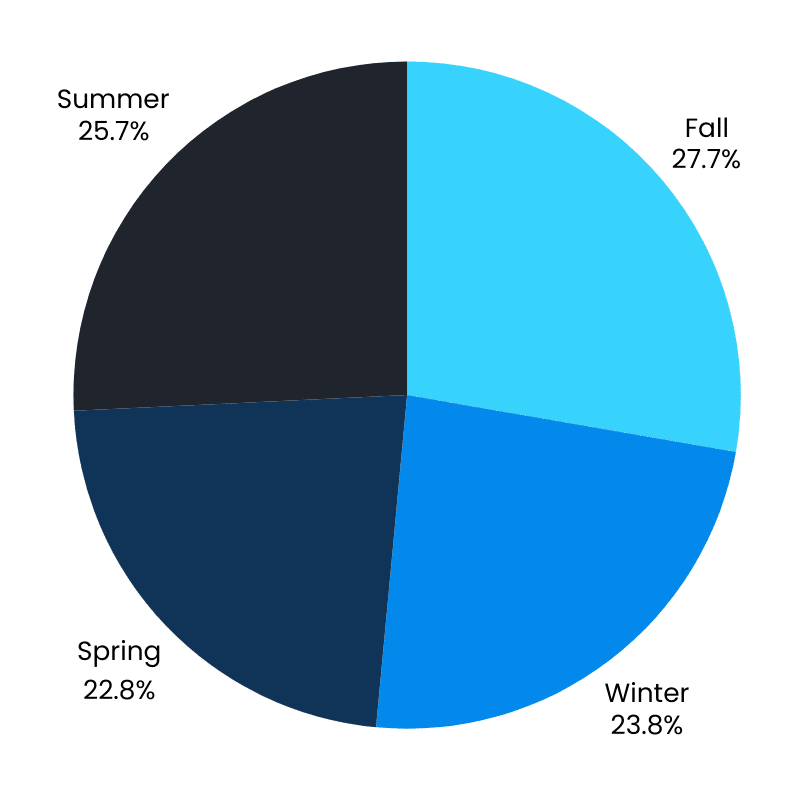

Low Seasonality:

Demand During EVERY Season

Housing Market in Mobile, AL

Median Home

Price

$240k

Median Household

Income

$29.3k

Average

Rent

$1,172k

"Affordable"

rent

$700-1,000

Winner Circle Current Monthly Rent

$559

Mobile Country has seen a 15% increase in RV registrations over the past theree years, outpacing the state average of 10%

An Affordable Housing Solution in a Tight Housing Market

RV Parks have evolved as more than just outdoor hospitality and are now an alternative solution to affordable housing

- Recession resistant housing option

- Multi-family amenities without the cost

- Pet-friendly housing.

- Flexible rental agreements.

- “Homeownership” without land ownership.

Recession Resistant Asset

- Demand for RV parks increases during recessions

- We just own the land; tenants maintain their own RVs

- Higher profit margins than multifamily

Lower-Risk Development than Multifamily

- Minimal vertical construction

- Few variables that impact the development budget

- Short development time frame (9 months)

An Excellent Portfolio Diversification Asset

RV park communities offer built-in income diversification

- Reliable income from long-term residents

- Premium rates from short-term hospitality rentals

- Laundry facilities generate additional revenue

- Electricity bill-back

- Potential for easy additional income diversification through storage, additional EV charging, vending machines, and other amenities

RV parks are ideal for diversifying any existing investment portfolio.

❝ The professional acumen and market insight demonstrated by Ben Spiegel and the Redwood team throughout this venture are commendable, exemplifying a results-driven approach that inspires confidence. ❞

Matt Cawley

President of National Multifamily

❝ The transparency from Redwood Capital is unparalleled. Their monthly investor updates keep me well-informed about my investments and the market, fostering a level of trust and engagement I haven’t experienced with other firms. This open communication is a cornerstone of their service and greatly appreciated. ❞

Ted Koly

Financial Advisor – Portfolio Manager, Morgan Stanley

❝ As the Founder & President of Brahman Capital, a multi-billion dollar long short public equity hedge fund with a 30-year track record, it is very difficult to find the time to analyze middle market private investment opportunities. RCA has been my go-to for off-the-run special situations since 2017. ❞

Mitch Kuflik

Founder of Brahman Capital

Stay In Touch

Not ready to invest?

Join our newsletter to stay informed about upcoming investment opportunities.