343 Manville Road involved the acquisition of a unique 13,000 square foot special purpose building comprising 15 units, located in the heart of Pleasantville, New York. The property underwent significant renovations in 2017, enhancing its appeal and functionality and generating significant investor returns.

Property Details

| Acquisition Date | No. of Unit/s | Location |

| April 2015 | 15 | Pleasantville, NY |

Returns

343 Manville Rd resulted in a notable financial success: purchased for $1.05M and renovated for over $900K, it was refinanced in 2020 at a $4.2M valuation, yielding over $2.25M in returns.

343 Manville Rd

This case study explores the strategic acquisition of a unique 13,000 square foot special purpose building comprising 15 units, located in the heart of Pleasantville, adjacent to the Metro North train station. Nestled in the bustling downtown area of Pleasantville, Westchester County, New York, this property underwent significant renovations in 2017, enhancing its appeal and functionality.

Location

The property is advantageously situated near the Jacob Burns Movie Theater and is a short distance from the Metro North Train Station, a 40-minute ride into Manhattan. It benefits from high pedestrian traffic and excellent visibility, making it a golden investment opportunity.

In Pleasantville, there has been a notable increase in development activities, especially in the downtown area. Recent years have seen the completion of significant projects such as a mixed-use structure on Washington Avenue and the 68-unit Toll Brothers development. Another development of over 70 residential units is underway near the Saw Mill Parkway.

Additionally, a 20-acre site is being marketed for up to 100 condo units. There are more than 103,000 residents in five miles. Within one mile of this asset, the average household income is greater than $160,000.

Background

The building was listed for sale on 2/19/15 and was sold on 4/22/15, spending a total of 27 days on the market. The prime location and curb appeal made the building a highly sought-after acquisition opportunity. Redwood Capital Adisors was one of many bidders but ultimately won with a $1.05M all-cash 30-day close offer “as-is” with no contingencies.

At acquisition, the building was made up of 3 retail spaces and 10 offices on both the first and second floor. The seller was a second-generation owner who had let the building fall into disrepair by not investing the necessary CapEx to keep the property updated, resulting in significant vacancies and below-market rents. The last renovation took place in the mid-1980s.

RCA made the strategic decision to get a zoning variance and appear before the architectural review board to implement a massive renovation to both the interior and exterior, investing >$900K with the goal of bringing the rents up to market and achieving 100% occupancy. The renovation project took over 14 months, reaching completion by mid-2018. In 2020 RCA refinanced the building at a $4.2M valuation enabling a ~$2.25M distribution.

RCA was awarded The Pleasantville Real Estate Developer of the Year award by the Chamber of Commerce in 2018 for the repurposing and renovation of 343 Manville Road.

Business Plan

The previous owner, who had inherited this and other properties in Pleasantville from his father, was not a savvy operator and lacked foresight. He sold this building along with all the others just a couple of years before massive development started occurring both next door and across the downtown area, increasing commercial building values throughout the Village.

Prior to closing, RCA formulated a strategic plan that would restore the building located in one of the most visible and most trafficked downtown locations. RCA has a strong track record of purchasing underperforming real estate in prime locations that could be returned to “greatness”whether through complete redevelopment or extensive renovations, as seen in Ardsley and Mount Kisco, Westchester County, New York. They also already own Tutor Time located just up the street, giving them an existing presence in the area.

The strategic business plan included appealing for a zoning variance to diversify leasing options beyond mere office space. The zoning variance was crucial to RCA’s strategy as they did not want to make such a large investment unless they could change the use from office, especially in the 4,500SF “back space”. The approval process extended over six months, followed by submissions to the architectural review board for significant external modifications. Upon receiving approvals, RCA filed for the building permits and began construction.

The building’s interior was demolished down to the studs, replacing everything from the mechanical systems, to walls, floors, and bathrooms. It became an empty shell. Externally, RCA replaced the middle glass pane windows, both roofs, parapets, and various other elements.

After about 12 months of work, the building was completely “white boxed” and ready to be leased. The renovation project resulted in >$900K investment that was financed through a construction to permanent loan as RCA paid for the building in cash.

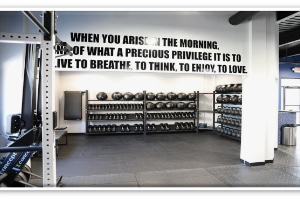

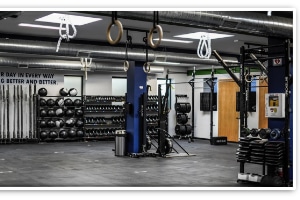

The second floor was transformed into eleven “micro” offices with shared amenities for a “plug and play” experience, quickly attracting tenants. The spacious 4,500SF ground floor area was leased to a CrossFit studio for ten years at over $32PSF, with escalations. The three retail spaces were also filled.

By 2018, the property reached full occupancy with rents up to market levels. In early 2020, a refinance valued the building at $4.2M valuation, enabling a >$2.25M distribution.