Strategy

We specialize in the development, acquisition, and operation of middle market commercial real estate and outdoor hospitality.

We are now strategically focusing on the development of luxury RV destinations, as well as acquisitions of existing multifamily dwellings and mixed-use properties.

We thrive in identifying and capitalizing on overlooked opportunities, targeting transactions ranging from $4 million to $15 million.

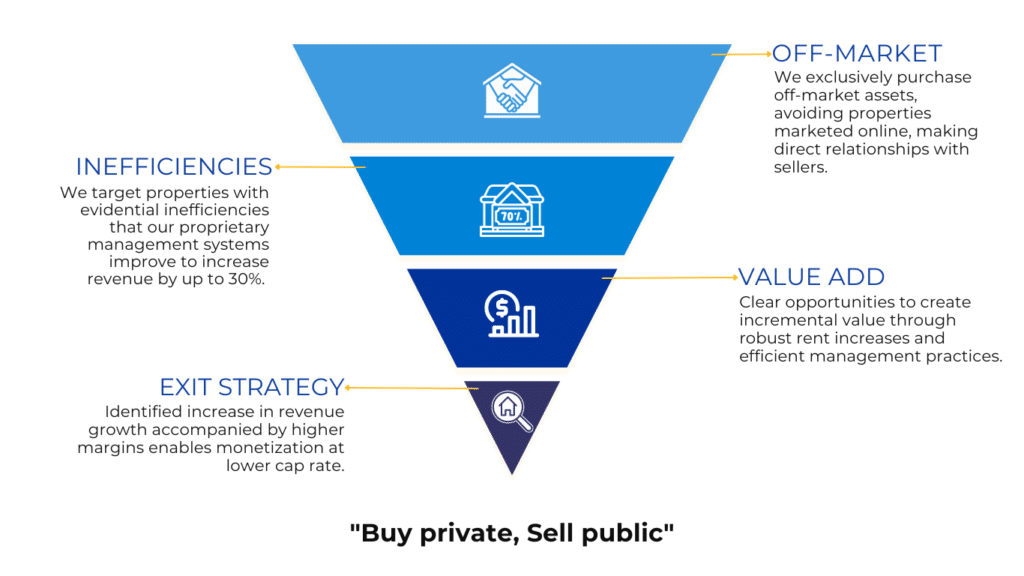

Our competitive edge stems from our relationship network, enabling access to off-market assets where we are not involved in a competitive bidding process. We identify for properties with inefficiencies in which our institutional management systems create immediate added value.